We often hear the word propaganda in the press and in the media. I wonder what kind of force this represents. The competitive force is always the one that comes first to mind. This is because I think of economics and social behavior. Yet propaganda is the ability to set the narrative, it is the ability to change a person’s mind. How does one include such a force in a detailed theory of behavior? Is the narrative a gravitational field that draws all under its sway to move in the same direction, friend and foe alike? Does this field owe its strength to some type of concentration of mass or energy at some strategic location? Might we call it strategic capital? How do I see that such a narrative effectively describes the process? Is this narrative distinct from other cooperative forces as well as any competitive forces? How would I tell?

To approach an answer to these questions that might be acceptable to most reasonable audiences, I anticipate that I must overcome a general fear such audiences have of numbers being used to describe human behaviors. Perhaps it is more general. In many cases we don’t like using numbers even when describing physical events. Take our conversation of weather. Are we more comfortable in reducing weather to a yes/no prediction of rain tomorrow than in understanding the complexities of airflow, humidity and pressure as a function of time? The former is like a person deciding, albeit an unknown weather god. The latter involves taking a stand on understanding. I think we are most comfortable with a yes/no prediction.

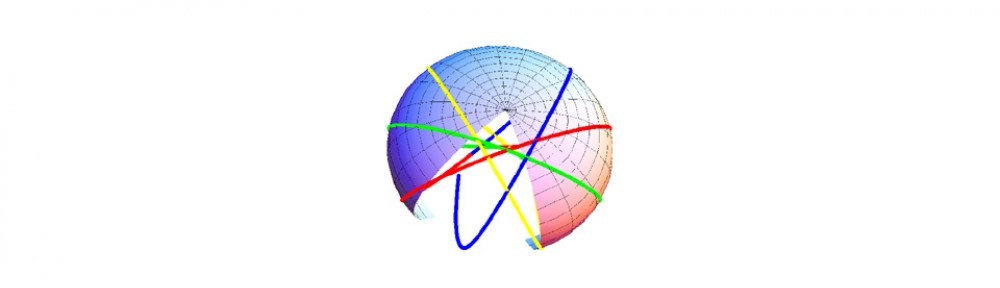

What is involved in the more complex understanding? Weather phenomena are not the acts of a capricious god but are the result of a process involving interacting parts spread out in both space and time. This process occurs in a continuum over space and time. What is happening here and now is dictated by what has happened elsewhere in the past. This is true at every level of scale, not only from a macroscopic but a microscopic perspective. A process view is based not just on a qualitative and discrete yes/no understanding but a quantitative description. The quantitative description provides the geometry; without this geometry the process is hidden.

But, you raise the valid objection that social phenomena are inherently uncertain and intrinsically about decisions which are discrete yes/no type outcomes. How can such events possibly be described as part of a continuum? My choice at this instant does not continuously flow from choices made in the past. It is a gamble and I might in fact, if given the chance, make exactly the opposite choice. Yet even in physics we have phenomena at the quantum level that from a certain point of view are uncertain and if viewed in a certain way, appear to be discontinuous. That fact has not prevented us from looking at them from another point of view as being described by a differential geometry in both time and space. Indeed, we suggest that game theory has provided us a perspective that social interactions in fact can be viewed geometrically if we focus on the mixed strategies and how they evolve in time as opposed to the pure strategies that focus on the uncertainties. We don’t focus on the actual decision, but on the mixture of decisions that are possible at any point in time.

As an example, consider that over the last decade, wealth has redistributed itself dramatically (Piketty, 2014). It has not happened discontinuously. It has evolved over time and appears to change continuously across social strata. Some members of the middle class have become wealthy whereas others have become poor. The changes reflect a process, not a capricious set of changes. The process is even more in evidence over long time scales of centuries. These then might be examples that we can focus our attention.

Suppose we analyze the flow of wealth and assume for simplicity it is distributed to two distinct populations. If the populations are valued similarly and if the interaction is zero-sum, we expect each to receive the same payoffs in the sense that what one wins, the other loses. But what if one population believes their payoff, if they win, is much higher than the other population? We still achieve a zero sum type game if we balance the product of the population and value for each side. If it is agreed that one side is 10 times more valuable, then this works if the other side has 10 times the population. What matters here is the interplay between competition and propaganda, since there may in fact be no objective reason for the valuation other than a possibly enforced agreement. This then is an example from the data supporting the geometric geometry view, since we can see how the flows change as a function of wealth distribution.

So we return to the question of propaganda and narrative, which we view as a question of process. In the above example, the valuation of wealth is felt equally by both populations, yet it may not be factually based. From a theoretical point of view that is really fine. We are not establishing the “truth” of the valuation, but the outcome given that both sides adopt this “truth”. Whether this is a useful exercise is ultimately a question of measurement and quantitative analysis. In a differential geometry theory of decision processes, we look for confirmation in data (behaviors) that highlight the existence of the process. For example, for weather predictions, it is not enough to predict rain versus not rain; rather we must predict in addition behaviors that change continuously with space and time like air flow. Therefore, for social behaviors we must look for flows, as an example, which change continuously with strategic position and time.

We seek to gain understanding from two distinct directions. We look at data to be convinced social behaviors are in fact geometric processes and we look at results of theoretical simulations to be convinced that geometrical processes might explain such data. At some point we hope that these two approaches meet, even though we are not there yet.